Is it just me or does the Budget announcement feel kind of like a corporate AGM?

And more importantly, why does it feel like we're not the shareholders?

Voting in leaders. Spending plans. Investment plans. Effects on economic markets. There’s a fair amount of overlap between Government Budget Annoucnements and Company Annual General Meetings (AGMs), so it’s not that surprising that listening to Rachel Reeves announce the Budget felt like a speech for shareholders of UK Ltd.

That might seem like a catty insult about her speech, but it’s not a bad thing. AGMs can be pretty democratic. Shareholders get to vote and have their say. But I’m interested in what today’s Budget reveals about who the Government considers the true shareholders of UK Ltd.

Spoiler alert: I don’t think it’s all the people who live in the UK, but I do think we can start to change that.

What does this shareholder meeting analogy actually mean and why are you using it?

Listen, there’s a fair bit of overlap between the Budget and an AGM, as I alluded to above. But there’s a few key differences which I think help us understand:

What is influencing the Government

Why it can feel so hard to mobilise people

Whether your campaigning and influencing strategies and narratives are fit for purpose

So, to get there, let’s look at the similarities first:

Both are opportunities for leadership to set out plans for the year, the money that will be spent that year, the expected return on investment, and the longer-term strategy to stakeholders.

Leadership of companies with shareholders and of Government typically involves some level of democracy, shareholders will get to vote on the board/directors and residents get to vote for MPs.

Stakeholders in both cases will involve individual, companies, financial institutions and others.

The outcomes of both have impacts on and are affected by broader financial markets.

Now, to the interesting bit - the differences:

In an AGM, the stakeholders will usually be the shareholders - the ones that own bits of the company and have a financial stake. For the Budget, the stakeholders are people, charities, businesses, etc in the UK with or without a financial stake.

In an AGM, the stakeholders have a level of voting power over the plans and decisions that the director or broad has presented. For the Budget, there is no official voting on the proposed measures.

In an AGM, voting on leadership positions is usually tied to the proposed plans. For the Budget, the voting on leadership positions is out of sync - you’re voting a new Government in based on pledges, a previous Government in or out based on past performance.

In an AGM, proposed plans are usually influenced by the shareholders desires, whether that’s dividends or sustainability commitments. For the Budget, well, the influence varies depending on who has the most power - or perceived power - over the Government’s decisions at that moment in time.

So, who has the most power or perceived power over the Government’s decisions right now?

In other words, who does the Government think their shareholders are? Now, we’ve gotten to the point of the analogy!

I think the Chancellor’s speech can be reverse engineered to show who the Government is listening to, i.e. who the metaphorical shareholders are.

For the political nerds in the room, this probably won’t be a surprise, but stick around anyway because that’s not the grand reveal.

There was so much talk about growth, but what does that actually mean and who gets to grow?

When we’re talking about growth in this context, we’re talking about the Office for Budget Responsibility (OBR)’s growth projections, which use Gross Domestic Product (GDP) to define growth.

My layperson’s understanding of GDP is that it measures the total value of goods and services, so when we’re talking about GDP in the UK we’re talking about the total money spent on goods and services created in the UK in any given year.

But the money spent year to year could increase or decrease even if the amount of goods and services being bought and sold stayed the same because of inflation or deflation, so economists do some sums to arrive at “real GDP” to take that into account.

What’s really striking about how growth is defined and measured is that there’s a baked in assumption that if real GDP grows, that means there will be more jobs for people because production of more goods and services means more people are needed to produce.

But, it doesn’t measure jobs. It measures monetary value, which is tied to business revenue.

I’m no economist but it sure does seem like GDP could, for example, grow if businesses lowered quality standards so our stuff was cheaper and faster to make, and we had to replace it more often. Or if food delivery apps started stacking orders so one driver does multiple drop-offs, or if it cost more to order groceries on an app.

This monetary value thing is interesting because it’s got so few perimeters. A bunch of small businesses could go bust and be replaced by a big corporation and GDP could go up, so I guess we’ve successfully grown and it’s a good thing?

The other fun thing about GDP is that because it measures monetary value, it leaves out any productive activities that don’t make money. Caring responsibilities or volunteering are not measurements of success under this framework.

Shareholder Test #1: If the speech focused on growth, and we know that successful growth is entirely based on business revenue, not on employment levels or societal impacts and doesn’t care what business it is and what they produce - then we can assume that big business is likely to have hefty influence as they will have the easiest time scaling up to produce more, which will get the Government to their measurement of success the fastest.

Let’s grow our carbon emissions, while we’re at it

This whole growth as success thing sure does put us in a pickle about climate change, because it requires more purchasing and less activity without monetary value.

More ordering cold overpriced takeaway with packaging delivered via motorbike because you’re too burnt out by your job to cook, less taking it in turns with people in your community to cook healthy meals from scratch with local ingredients.

But it’s not just growth that’s a climate issue, there’s also some interesting implications about transport and choices that could increase or decrease our reliance on fossil fuels and cars.

Travelling by bus was made more expensive, as the bus fare cap - which is the amount of the full ticket - went up by 50% from £2 to £3 and is capped until 2025

Cheaper diesel and petrol was extended with the 5p fuel duty cut kept for another year

Rules around Vehicle Excise Duty changed to incentivise people buying new cars to get electric ones

Train upgrades uniting cities in the North of England are being funded

Air Passenger Duty will go up, but is only expected to add on £2 at most to short-haul economy flights, but will go up by 50% for private jet passengers

So, what is going on here? First things first, I’m going to leave out the train upgrades. They are exciting, but train prices are unfathomably high most of the time, and there was no mention of making train travel less or more expensive.

I want to look at how we are being financially incentivised or discouraged to use different travel methods for a single trip in this Budget and who that benefits:

We are being financially discouraged to take the bus with a 50% trip increase

We are being financially encouraged to drive petrol and diesel cars with 3.6% trip decrease maintained*

We are being financially discouraged from taking short-haul international flights with a 4.25% trip increase*

We are being financially discouraged from taking private jet flights with a 0.07% trip increase*

So, for all the talk of increasing ADP for private jets by 50%, in terms of overall trip cost that is the lowest of all the trip increases we saw. Bus commutes are discouraged the most while driving is incentivised.

This is a classic AGM move in 2024, a lovely little bit of greenwashing.

Shareholder Test #2:

If good, accessible, cheap public transport was available to more of us would as many people be driving? I think it’s reasonable to say probably not.

Now, what about keeping driving cheaper and at the same time making public transport expensive? Does it go the other way and make people drive more?

The people who are already driving feel like they got a win which is a nice benefit, but more people driving really benefits the car and fossil fuel industries - and the car industry really benefits, because those nice electric cars are also financially incentivised.

That means for people who have the climate crisis in the back of the heads but are disincentivised to take public transport, the car industry benefits from their purchase of an electric car.

Again, a lower cost for the consumer is a nice benefit, but for wide reaching public impact that helps people out financially and helps with a green transition you just absolutely would not being financially disincentivising the bus.

Now, onto aviation. For economy flights, it’s probably not going to massively disincentivise people from flying. It’s also not necessarily winning you the love and admiration of the aviation industry, but it is most certainly not making any enemies.

Particularly because this is a cost for them to pass directly on to the consumer, instead of any form of tax or levy on the company’s profits.

And finally, our private jets. I mean, I think that both the aircraft manufacturers and the wealthy will love this one. This was a masterstroke of seeming like the wealthy were being forced to cough up more and were being punished for their climate crimes, but I don’t think a £6 increase on an £8k trip is going to deter anyone from buying or chartering a jet.

So, our shareholders here are the car industry, the aviation industry, the fossil fuel industry, and people wealthy enough to be using private jets. They’re the ones likely to have power and influence over Labour.

The Tory Government ate my homework

At this point, dear reader, you might be feeling despair that civic society and individuals don’t seem to have much power and influence based on this budget.

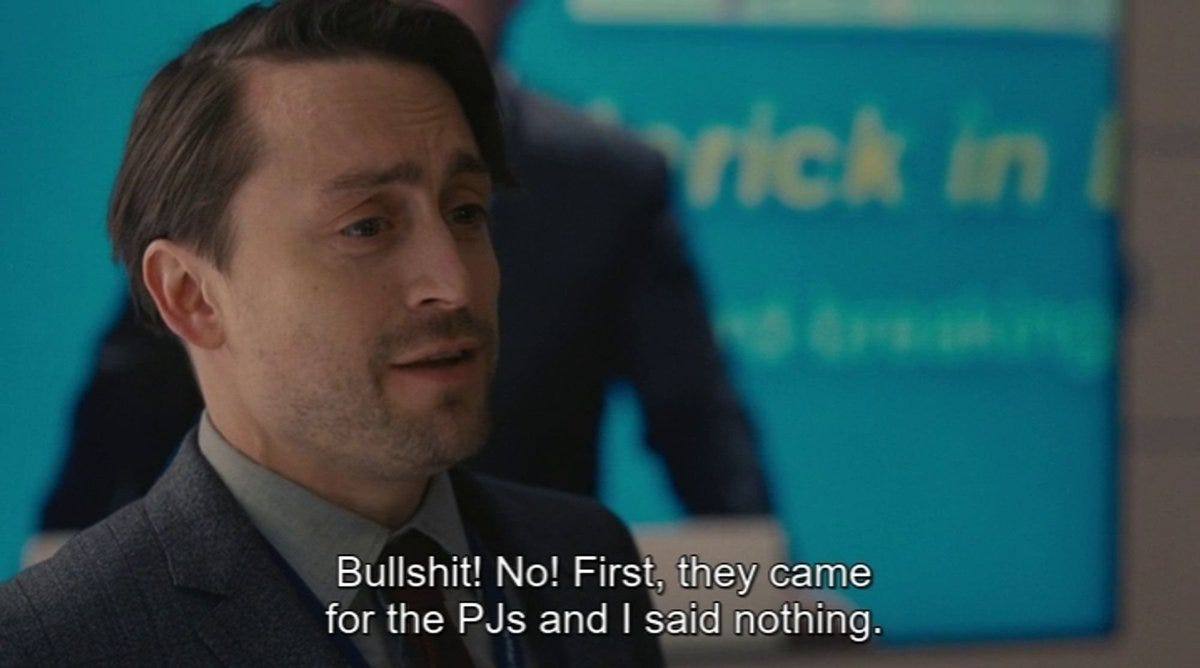

But, Labour have been in power for a few months, and they’re still acting like it’s an election campaign in a lot of ways. Continued attacks on the last Government, speeches intended to appeal to the public about how our problems are down to Boris Johnson, Liz Truss, and Rishi Sunak.

Minimum wage increases, carers being able to work more hours, compensation for victims of the infected blood scandal, more money for affordable housing. These are all meant to hit that “working people” target.

I don’t think we’re being treated like shareholders, but I do think we’re being treated like consumers. It makes sense, this was a digital election, and all that marketing can sure make it seem even more like a politician’s job is to convert us into a sale instead of serve us.

But this wasn’t an AGM. The UK isn’t a company. To get into Government, you still need voters and unlike a company and its customers, you have to sell people on a politician, their party, the legitimacy of parliament itself, and the act of voting in an election being worthwhile. Companies just have to get you to pay for something.

2024 was the second-lowest election turnout in history. Reform won seats. There was a revolving door of Prime Ministers the years prior. Labour are already fighting for the next election, and that means if enough of us remember that the Government is meant to be working for us, get excited about democracy and collectively demand better then campaigning for progressive policy and practice will be easier.

Not because we’ll be stronger and louder than donors with big pockets, necessarily. But because the pool of voters that parties need to get on board will be bigger, and have a bigger impact. That takes time, so I think a lot of campaigning and advocacy energy should go there right now.

We need to convince people democracy is worth it instead of convincing the Government our policies are.

Actionable Tips

Campaigners as a whole don’t think about local government enough. Councils and Metro Mayors have more power than people realise, they can change things people interact with everyday, and they don’t hear from the public that much. I complained about how there were no streetlights on the paths to and from a tram station, and everyone told me it was pointless because the council never did anything and it had been like that for years. Seemingly, no one had written to the council, because it took two emails to get them to agree and three follow-up emails for the lights to be installed. Consider how your policy asks could be implemented by councils, and then recruit a small group of people in target councils to join your campaign.

I genuinely think there’s a bit of a problem in the campaigning and advocacy space and that problem is the vast majority of us are into politics. Most people are not. Parliament is full of people making digs at each other based on party political lines and in jokes, and BBC News spends an inordinate amount of time covering the race for Tory leadership despite the fact that who wins is not going to impact people’s lives right now. Stop talking about politicians and party politics, and start talking about the mechanisms to get stuff done. How does a proposed policy turn into a law, how does the Government consult the public for their views, what’s the relationship between someone’s MP and the PM? Show people that there are actual processes in Westminster, and it’s not just full of benches where people sit and jeer at their opponents.

We need to talk to people and find out why they’re not voting, why they voted for Reform, what they think the role of Government is.

I started my campaigning career nearly a decade ago working on corporate tax avoidance, and the constant refrain in the office was “how do we make tax sexy?” Tax is still desperate for a rebrand, but it doesn’t need an extreme makeover. Tax seems like money that is taken away from us as some form of punishment, goes to Government and is never seen again. But it’s our money. For our infrastructure. For our services. For fun community arts festivals and for fixing potholes. Start talking about how it’s our money and get excited about what a wad of collective cash could be invested in.

* A note on how I calculated the sums

The Fuel Duty Cut

Assuming petrol is 150p per litre, 35% of the total cost is fuel duty which is 52.95p per litre.

Assuming an average fuel efficiency of 35-40 miles per gallon (mpg) for a typical UK vehicle.

Assuming for a 20-minute trip, assuming an average speed of 20-25 mph, the distance traveled would be approximately 6-8 miles.

This trip would use 0.15-0.20 litres of petrol, meaning the cost with the fuel duty cut would be 22.5p-30p.

Without the fuel duty cut, let’s assume petrol is 155.45p per litre. This same trip now costs 23.31p-31.09p.

Let’s go with the lower end of the scale to work out the percentage increase.

Percentage Increase = ((23.31p - 22.5p) / 22.5p) × 100 = 3.6%

I haven’t factored in overall running costs of a car, as I’m assuming they will not affect the trip price - what we’re interested in here is how much the trip cost is affected, which is variable based on the Fuel Duty Cut.

The international economy flight

I calculated this using an EasyJet flight from Manchester to Geneva on 04/11/24, because according to the Telegraph1 it’s people going to the Alps that will bear the brunt of this increase. At time of checking, that was £46.99 with £13 of that being APD. That will go up to £48.99 with £15 of that being APD.

Percentage Increase = ((48.99 - 46.99) / 46.99) × 100 = 4.25%

The private jet flight

I calculated this using PrivateFly’s quotation for a private jet ride with one passenger from Manchester to Geneva on 04/11/24. My cheapest option is a Turboprop Aircraft at a bargain £8190 and classifies as a small private jet.2 The distance between Manchester and Geneva is 616 miles, meaning it is in Band A. Band A for a small private jet is increasing from £26 to £32, meaning my private jet trip will increase to £8196.3

Percentage Increase = ((8196 - 8190) / 8190) × 100 = 0.07%

https://www.telegraph.co.uk/travel/news/air-passenger-duty-tax-budget/

https://www.privatefly.com/privatejet-services/air-passenger-duty-private-jet-partners.html

https://assets.publishing.service.gov.uk/media/6720f92b10b0d582ee8c4809/Reform_of_Air_Passenger_Duty_for_private_jets.pdf